The law surrounding probate can be complex, especially when a significant amount of time has passed since the decedent's death. While there's a good reason for the probate process, it can become difficult to navigate if it's not handled promptly.

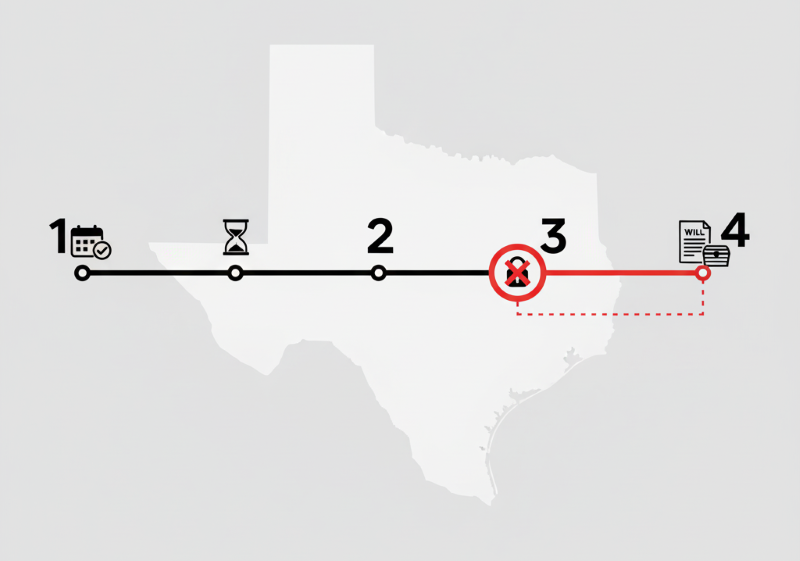

The Four-Year Rule

Texas law includes a provision that makes probating a will challenging after four years. Specifically, Texas Estates Code § 256.003 states that you are barred from probating a will if four years have passed since the decedent's death, and letters testamentary or of administration will not be issued.

However, there is another section of the Estates Code that seems to create a conflict. It allows for the probate of a will after four years, as long as the person applying is not "in default," and the estate is owed money. Despite this, the current trend in Texas courts is to deny the admission of wills to probate after this period, aiming to encourage people to act more quickly. This can leave heirs in a difficult spot when they discover assets they didn't know about.

An Alternative: Determination of Heirship

One legal option that doesn't have a time limit is a determination of heirship. This is a court-supervised process used to legally determine a decedent's heirs and their respective shares of the estate when there is no valid will or the will cannot be probated. This can be a viable path for those who are unable to probate a will after the four-year mark.

Conclusion

Despite the court’s usual position of disallowing probates after four years, there are exceptions. Courts are typically sympathetic to compelling reasons to probate an estate after default has occurred. One notable exception occurs when an estate is later owed money that the beneficiaries or heirs could not have foreseen during the four year period. It is prudent to consult an experienced probate attorney when a probate becomes necessary after the typical time to probate has lapsed.

All information provided on Silblawfirm.com (hereinafter "website") is provided for informational purposes only, and is not intended to be used for legal advice. Users of this website should not take any actions or refrain from taking any actions based upon content or information on this website. Users of this site should contact a licensed Texas attorney for a full and complete review of their legal issues.